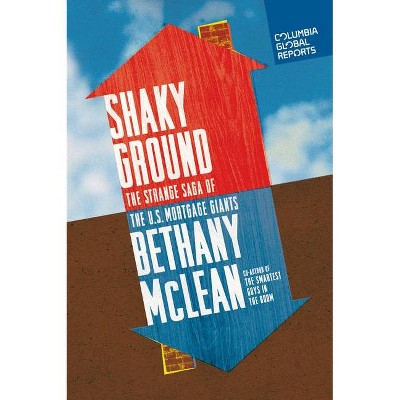

Shaky Ground - by Bethany McLean (Paperback)

Similar Products

Products of same category from the store

AllProduct info

<p/><br></br><p><b> Book Synopsis </b></p></br></br><strong>Fannie Mae and Freddie Mac were created by Congress to serve the American Dream of homeownership. By the end of the century, they had become extremely profitable and powerful companies, instrumental in putting millions of Americans in their homes.</strong> <p/> <strong>So why does the government now want them dead?</strong> <p/> In 2008, the U.S. Treasury put Fannie and Freddie into a life-support state known as "conservatorship" to prevent their failure--and worldwide economic chaos. The two companies, which were always controversial, have become a battleground. Today, Fannie and Freddie are profitable again but still in conservatorship. Their profits are being redirected toward reducing the federal deficit, which leaves them with no buffer should they suffer losses again. China and Japan are big owners of Fannie and Freddie securities, and they want to ensure the safety of their investments--which helps explain why the government is at an impasse about what to do. But the current state of limbo is unsustainable. <p/> Based on comprehensive reporting and dozens of interviews, <em>Shaky Ground </em>chronicles the story of Fannie and Freddie seven years after the meltdown, and tells us why homeownership finance is now one of the biggest unsolved issues in today's global economy--and why it must be placed on firmer ground.<p/><br></br><p><b> Review Quotes </b></p></br></br><br><b><i>Washington Post</i> Notable Nonfiction Book of 2015</b><br><b>A <i>Washington Post</i> Bestseller</b> <p/> Bethany McLean has written an insightful guide to one of the fascinating true-financial-crime cases of our time. <b>--Simon Johnson, <i>Washington Post</i></b> <p/>Bethany McLean romps through the well-intentioned founding of Fannie and Freddie, via their gradual corruption to the current unhappy limbo, with the government and hedge funds fighting over the scraps in the courts.... McLean deftly steers a sensible course through the competing claims. <b>--Tom Braithwaite, <i>Financial Times</i></b> <p/>An excellent new book that attempts to make sense of the senseless history of Fannie and Freddie. <b>--Alan Murray, <i>Fortune</i></b> <p/>In a short, lucid paperback (or e-book) from a new publishing arm of Columbia University, McLean explains how the topsy-turvy world of Fannie and Freddie came to be and why government control of them likely will limp along indefinitely as the major unresolved issue of the financial crisis. <b>--<i>USA Today</i></b> <p/>The latest very smart finance book by McLean...[who] found a very good [topic] in our deeply flawed home mortgage system. <b>--<i>The National Book Review</i></b> <p/>Readers of this maddening, sharp report will rightly wonder why Fannie Mae and Freddie Mac have been allowed to survive and why we can't do better. <b>--<i>Kirkus Reviews</i></b> <p/>McLean ably describes a situation where, seven years past the brink of economic collapse, Fannie and Freddie are severely undercapitalized, faced with investor lawsuits, and caught up in political infighting that prevents either comprehensive reform or their ultimate abolition. <b>--<i>Publishers Weekly</i></b> <p/> Based on in-depth reporting and dozens of interviews with key players in Washington and Wall Street, Shaky Ground vividly describes how we got into this unsustainable situation--and why everyone should care. This is business journalism at its best and a must-read for anyone concerned about a full recovery from the financial crisis. <b>--Porchlight</b><br><p/><br></br><p><b> About the Author </b></p></br></br><b>Bethany McLean</b> is an investigative journalist known for her work on the Enron scandal and the 2008 financial crisis. In 2001 as a young reporter at Fortune magazine, where she eventually became an editor at large, she wrote Is Enron Overpriced?, one of the first skeptical articles about Enron. After the company collapsed into bankruptcy, she coauthored the bestseller, <i>The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron</i> with her Fortune colleague Peter Elkin. A documentary based on the book was nominated for an Academy Award in 2006. Her most recent book, which she coauthored with New York Times columnist Joe Nocera, is <i>All the Devils Are Here: The Hidden History of the Financial Crisis</i>. Prior to joining <i>Fortune</i> she had been an investment analyst at Goldman Sachs. She is a contributing editor at <i>Vanity Fair</i>, a columnist for Fortune.com and a contributor to CNBC. A graduate of Williams College, she lives in Chicago.

Price History

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messages communication@pricearchive.us