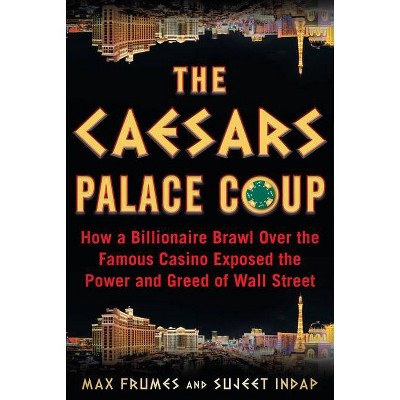

The Caesars Palace Coup - by Sujeet Indap & Max Frumes (Hardcover)

Similar Products

Products of same category from the store

AllProduct info

<p/><br></br><p><b> About the Book </b></p></br></br>"It was the most brutal corporate restructuring in Wall Street history. The 2015 bankruptcy brawl for the storied casino giant, Caesars Entertainment, pitted brilliant and ruthless private equity legends against the world's most relentless hedge fund wizards. In the tradition of Barbarians at the Gate and The Big Short comes the riveting, multi-dimensional poker game between private equity firms and distressed debt hedge funds that played out from the Vegas Strip to Manhattan boardrooms to Chicago courthouses and even, for a moment, the halls of the United States Congress. On one side: Apollo Global Management and TPG Capital. On the other: the likes of Elliott Management, Oaktree Capital, and Appaloosa Management. The Caesars bankruptcy put a twist on the old-fashioned casino heist. Through a $27 billion leveraged buyout and a dizzying string of financial engineering transactions, Apollo and TPG--in the midst of the post-Great Recession slump--had seemingly snatched every prime asset of the company from creditors, with the notable exception of Caesars Palace. But Caesars' hedge fund lenders and bondholders had scooped up the company's paper for nickels and dimes. And with their own armies of lawyers and bankers, they were ready to do everything necessary to take back what they believed was theirs--if they could just stop their own infighting. These modern financiers now dominate the scene in Corporate America as their fight-to-the-death mentality continues to shock workers, politicians, and broader society--and even each other. In The Caesars Palace Coup, financial journalists Max Frumes and Sujeet Indap illuminate the brutal tactics of distressed debt mavens--vultures, as they are condemned--in the sale and purchase of even the biggest companies in the world with billions of dollars hanging in the balance." --<p/><br></br><p><b> Book Synopsis </b></p></br></br><b>It was the most brutal corporate restructuring in Wall Street history. The 2015 bankruptcy brawl for the storied casino giant, Caesars Entertainment, pitted brilliant and ruthless private equity legends against the world's most relentless hedge fund wizards.</b> <p/> In the tradition of <i>Barbarians at the Gate</i> and <i>The Big Short</i> comes the riveting, multi-dimensional poker game between private equity firms and distressed debt hedge funds that played out from the Vegas Strip to Manhattan boardrooms to Chicago courthouses and even, for a moment, the halls of the United States Congress. On one side: relentless financial engineers Marc Rowan, David Sambur, and David Bonderman with their teams at Apollo Global Management and TPG Capital. On the other: superstar distressed debt investors Dave Miller and Ryan Mollett with their cohorts at the likes of Elliott Management, Oaktree Capital, and Appaloosa Management. <p/> The Caesars bankruptcy put a twist on the old-fashioned casino heist. Through a $27 billion leveraged buyout and a dizzying string of financial engineering transactions, Apollo and TPG--in the midst of the post-Great Recession slump--had seemingly snatched every prime asset of the company from creditors, with the notable exception of Caesars Palace. But Caesars' hedge fund lenders and bondholders had scooped up the company's paper for nickels and dimes. And with their own armies of lawyers and bankers, they were ready to do everything necessary to take back what they believed was theirs--if they could just stop their own infighting. <p/> These modern financiers now dominate the scene in Corporate America as their fight-to-the-death mentality continues to shock workers, politicians, and broader society--and even each other. <p/> In <i>The Caesars Palace Coup</i>, financial journalists Max Frumes and Sujeet Indap illuminate the brutal tactics of distressed debt mavens--vultures, as they are condemned--in the sale and purchase of even the biggest companies in the world with billions of dollars hanging in the balance.<p/><br></br><p><b> Review Quotes </b></p></br></br><br><b>Praise for <i>The Caesars Palace Coup</i></b> <p/> "<i>The Caesars Palace Coup</i> recounts in exquisite detail the extraordinary lengths that Marc Rowan and David Sambur, his Apollo partner, went to stave off the inevitable bankruptcy filing of Caesars in 2015, and the extraordinary lengths they went to during the two-year bankruptcy process to try to salvage their investment."<br> --<i>Vanity Fair</i> <p/> "An investigative deep-dive into an old-fashioned casino heist, which includes a $31 billion leveraged buyout and a string of financial engineering transactions by Apollo Global Management and TPG Capital--all in the midst of the post-Great Recession slump, pitting private equity firms and distressed-debt hedge funds against each other in an ultimate poker match."<br> --<i>Fortune</i> <p/> "A casino caper and legal thriller rolled into one.... An eccentric Illinois judge, whose final ruling ultimately stunned bankruptcy aficionados, and the rantings from the Masters of the Universe make the book entertaining, maybe essential, reading across Wall Street.... <i>The Caesars Palace Coup</i> helps make clear what such Wall Street clashes are really about: men with big egos swinging their lacrosse sticks." --<i>Reuters Breakingviews</i> <p/> "Lawyers and bankers duke it out in this thorough if dry history of the downfall of the Caesars Entertainment empire.... a welcome respite from stodgier case studies."<br> --<i>Publishers Weekly</i> <p/> "<i>The Caesars Palace Coup</i> is a superb inside account of what modern high finance is actually like--the strategies, the personalities, the relationships, the stress, and the shouting. Fascinating, suspenseful, and comprehensive, it is the <i>Barbarians at the Gate</i> of distressed debt."<br> --Matt Levine, <i>Money Stuff</i> columnist, Bloomberg Opinion <p/> "No story better captures early 21st century Wall Street like the bankruptcy of Caesars Entertainment. <i>The Caesars Palace Coup</i> is a well-researched, engaging modern-day corporate thriller, filled with epic courtroom and boardroom battles and the kinds of colorful characters that only exist on the buy-side. This is the fascinating inside story of a clash of the titans--the who's who of distressed hedge funds battling each other and private equity giants Apollo and TPG for their piece of the Las Vegas casino conglomerate. . . . [A] must read for anyone who loves the deals and the drama that so often characterize the ins and outs of Wall Street and corporate restructuring."<br> --Kristin Mugford, Harvard Business School <p/> "In <i>The Caesars Palace Coup</i>, two of Wall Street's most plugged-in journalists take us deep inside corporate raiding, 21st century style. Exploiting distressed debt instead of undervalued stock, buccaneer hedge funds and other vulture investors pay seventy, sixty, sometimes less than fifty cents on the dollar to scoop up controlling stakes in troubled companies. This breathtaking narrative culminates in bitter financial and courtroom warfare as Apollo Global Management, its allies, and its high-powered lawyers and lobbyists maneuver relentlessly against equally savvy investors to freeze them out of the resulting rise in profits and force them to accept a 'cramdown' settlement of their stakes in the company."<br> --Paul Steiger, former <i>Wall Street Journal</i> managing editor and founding editor of <i>ProPublica</i> <p/> "The distressed debt markets are the most rough-and-tumble corner of Wall Street, and Indap and Frumes have written the best book yet on the machinations, power moves, and personalities of the investors who make fortunes rolling the distressed debt dice."<br> --Jared A. Ellias, Bion M. Gregory Chair in Business Law, the University of California, Hastings <p/> There is so much to like in this book. Its primary strength is its Law & Order backstory, peeling back the onion of every major player...Four years of painstaking personal interviews have paid off handsomely in this fascinating account of the inner workings of big money and big law reorganization practice.<br> --Jason Kilborn, Credit Slips <p/><br>

Price History

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messages communication@pricearchive.us