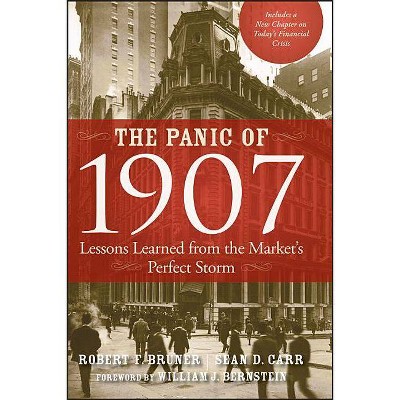

The Panic of 1907 - by Robert F Bruner & Sean D Carr (Paperback)

Similar Products

Products of same category from the store

AllProduct info

<p/><br></br><p><b> Book Synopsis </b></p></br></br>Before reading <i>The Panic of 1907</i>, the year 1907 seemed like a long time ago and a different world. The authors, however, bring this story alive in a fast-moving book, and the reader sees how events of that time are very relevant for today's financial world. In spite of all of our advances, including a stronger monetary system and modern tools for managing risk, Bruner and Carr help us understand that we are not immune to a future crisis.<br /> --Dwight B. Crane, Baker Foundation Professor, Harvard Business School <p>Bruner and Carr provide a thorough, masterly, and highly readable account of the 1907 crisis and its management by the great private banker J. P. Morgan. Congress heeded the lessons of 1907, launching the Federal Reserve System in 1913 to prevent banking panics and foster financial stability. We still have financial problems. But because of 1907 and Morgan, a century later we have a respected central bank as well as greater confidence in our money and our banks than our great-grandparents had in theirs.<br /> --Richard Sylla, Henry Kaufman Professor of the History of Financial Institutions and Markets, and Professor of Economics, Stern School of Business, New York University</p> <p>A fascinating portrayal of the events and personalities of the crisis and panic of 1907. Lessons learned and parallels to the present have great relevance. Crises and panics are as much a part of our future as our past.<br /> --John Strangfeld, Vice Chairman, Prudential Financial</p> <p>Who would have thought that a hundred years after the Panic of 1907 so much remained to be written about it? Bruner and Carr break significant new ground because they are willing to do the heavy lifting of combing through massive archival material to identify and weave together important facts. Their book will be of interest not only to banking theorists and financial historians, but also to business school and economics students, for its rare ability to teach so clearly why and how a panic unfolds.<br /> --Charles Calomiris, Henry Kaufman Professor of Financial Institutions, Columbia University, Graduate School of Business</p><p/><br></br><p><b> From the Back Cover </b></p></br></br><p><i>Praise for</i> <b>THE PANIC OF 1907</b> <p>"Before reading <i>The Panic of 1907</i>, the year 1907 seemed like a long time ago and a different world. The authors, however, bring this story alive in a fast-moving book, and the reader sees how events of that time are very relevant for today's financial world. In spite of all of our advances, including a stronger monetary system and modern tools for managing risk, Bruner and Carr help us understand that we are not immune to a future crisis."<br/> <b>--Dwight B. Crane, Baker Foundation Professor, Harvard Business School</b> <p>"Bruner and Carr provide a thorough, masterly, and highly readable account of the 1907 crisis and its management by the great private banker J. P. Morgan. Congress heeded the lessons of 1907, launching the Federal Reserve System in 1913 to prevent banking panics and foster financial stability. We still have financial problems. But because of 1907 and Morgan, a century later we have a respected central bank as well as greater confidence in our money and our banks than our great-grandparents had in theirs."<br/> <b>--Richard Sylla, Henry Kaufman Professor of the History of Financial Institutions and Markets, and Professor of Economics, Stern School of Business, New York University</b> <p>"A fascinating portrayal of the events and personalities of the crisis and panic of 1907. Lessons learned and parallels to the present have great relevance. Crises and panics are as much a part of our future as our past."<br/> <b>--John Strangfeld, Vice Chairman, Prudential Financial</b> <p>"Who would have thought that a hundred years after the Panic of 1907 so much remained to be written about it? Bruner and Carr break significant new ground because they are willing to do the heavy lifting of combing through massive archival material to identify and weave together important facts. Their book will be of interest not only to banking theorists and financial historians, but also to business school and economics students, for its rare ability to teach so clearly why and how a panic unfolds."<br/> <b>--Charles Calomiris, Henry Kaufman Professor of Financial Institutions, Graduate School of Business, Columbia University</b><p/><br></br><p><b> Review Quotes </b></p></br></br><br>.,."a great academic study, which was meant to be a warning. Instead, it reads like a description of what has just happened."--"Financial Times" <P> "A dull textbook it's not: Most chapters amount to six or seven pages of storytelling with cliffhangers... entertaining read..."--"Bloomberg News" <P> .,."the definitive guide to the stock market panic of '07"--"The TImes" <P> "an important read..."--thestreet.com <P> "Bruner, dean of the University of Virginia's Darden School of Business, and Carr, director of the school's Batten Institute, tell the gripping tale of one of the worst financial panics in modern history, where greed and lack of liquidity (sound familiar, people?) dragged stocks down 37 percent."--U.S. News & World Report <P> "When The Business Press Maven first cast his eye for business journalism onto business books, it was with the ultimate hope of familiarizing investors with historical insight, which is more common in books than what is demonstrated in newsrooms and trading floors--where yesterday's news and trades qualify as fixtures from a bygone era . . . . That is why I am going to grant "The Panic of 1907: Lessons Learned from the Market's Perfect Storm," a resounding "Help" label from The Business Press Maven, putting it in the probable running for Top 10 Business Press Maven Books of 2007. In case you still don't get it, this is very high praise."--Marek Fuchs, The Business Press Maven, TheStreet.com <P> "This retelling of Morgan's bravura performance is a page-turning mix of high finance and high drama"--"Barron's" <P> .,."the definitive guide to the stock market panic of '07" ("The Times," Thursday 13th September 2007) <P> "Well worth reading" ("The Business,"Saturday 15th September 2007) <P> "With this book as their guide, readers will take away important insights...developing a deeper understanding of financial markets" ("What Investment?," November 2007) <P> "A very worthwhile book for advisors who, having just lived through a financial crisis of global implications, are casting about for a larger conceptual framework regarding such events."--"Financial Advisor" <P> "Steering clear of the extremes, the authors dissect the 'perfect storm' that blew through the financial system in 1907 and identify seven elements that converge to cause financial crisis . . . Timely read."--The Hindu Business Line (October 19, 2007) <P> "a useful book on market contagion" ("bloomberg.com," Wednesday 5th December 2007) <P> "Anyone who needs convincing that financial history is constantly repeating itself should pursue this timely tome." ("Spear's Wealth & Management Survey," January 2008) <P> "My column today quotes from one of the most insightful books I have ever read, "The Panic of 1907." When I read it last year, I thought it had lessons for today, but I did not realize just how quickly those lessons would become crucial."--Floyd Norris, New York Times <P> "A very relevant read in today's subprime infested financial environment." ("Gulf Business," February 2008) <P> "Bruner and Carr deliver more than just a good story." ("Risk," February 2008) <P> "Robert Bruner and Sean Carr, both scholars from the Darden School of Business at the University of Virginia, have written a very important book titled The Panic of 1907: Lessons Learned from the Market's Perfect Storm. <P> The value of Bruner and Carr's book is not only the detailed historical examination ofthe 1907 financial panic but the scholarly work they did in examining the financial panics that have occurred over the past one hundred years. It was by examining numerous panics that Bruner and Carr were able to develop an outline of how panics begin, spread, and how they are ultimately resolved." -Roger G. Hagstrom, Legg Mason Growth Trust, Investment Commentary and Quarterly Report to Shareholders (March 31, 2008)<br><p/><br></br><p><b> About the Author </b></p></br></br><p><b>ROBERT F. BRUNER</b> is the Dean of the Darden Graduate School of Business Administration and Charles C. Abbott Professor of Business Administration at the University of Virginia. He is the author or coauthor of more than 400 case studies and notes as well as the author of two other Wiley titles, <i>Applied Mergers and Acquisitions</i> and <i>Deals from Hell</i>. Bruner has served as a consultant to over twenty corporations and the U.S. government and, prior to his academic career, worked as a commercial banker and venture capitalist. He holds a BA from Yale University, and an MBA and DBA from Harvard University. <p><b>SEAN D. CARR</b> is the Director of Corporate Innovation Programs at the Darden School's Batten Institute, University of Virginia. Previously, Carr spent a decade as a journalist, having served as a producer for both CNN and ABC News's <i>World News Tonight with Peter Jennings.</i>

Price History

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messagescommunication@pricearchive.us