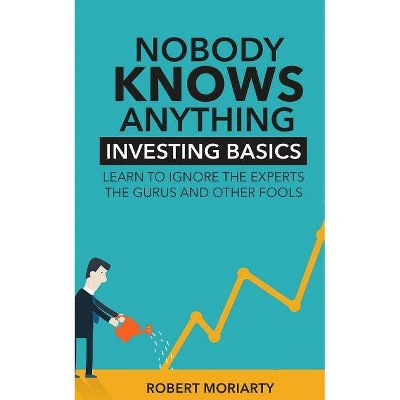

Nobody Knows Anything - by Robert Moriarty (Paperback)

Similar Products

Products of same category from the store

AllProduct info

<p/><br></br><p><b> About the Book </b></p></br></br>Investors not only need to know what to do to profit, they also need to know what not to do. Learn how to understand how humans think and act as a herd so you can avoid being part of the herd. What works in nature may well not work as an investor. The book discusses bubbles, when to sell, buzzwords and pitfalls waiting for every new investor.<p/><br></br><p><b> Book Synopsis </b></p></br></br><p>"Nobody knows anything ... Not one person in the entire motion picture field knows for a certainty what's going to work. Every time out it's a guess and, if you're lucky, an educated one."</p> <p>―William Goldman, <em>Adventures in the Screen Trade</em></p> <p>As the ongoing worldwide revolution demonstrated by Brexit, the Trump election, the Italian and French elections show, there are no experts; no gurus; only fools pretending to be gurus and experts. These fake experts lead both novice and experienced investors down a primrose path leading to constant losses and despair.</p> <p>In <em>Nobody Knows Anything</em> Moriarty begins by giving the reader excerpts from the 170 year old classic book on human behavior titled <em>Extraordinary Popular Delusions and the Madness of Crowds</em> by Charles Mackay. It's vital that new investors understand that crowd behavior is more important than investment fundamentals or technical analysis. If an investor knows what the mob is doing and understands the mob is always wrong, he or she can profit by doing the opposite.</p> <p>Other chapters discuss when an investor should sell an investment, why it's vital to understand the bias and agenda of a source and how the concept of deviation and regression to the mean can provide helpful investments tips. In short this book may not make an investor rich but it might prevent him from becoming poor.</p><p/><br></br><p><b> Review Quotes </b></p></br></br><br><p>A truism states that the best things in life often come in small packages. If that's the case, then for the wise investor - and those who desire to become one - Bob Moriarty's newest book, in an action-packed 113 pages - Nobody Knows Anything: Learn to Ignore the Experts, The Gurus and Other Fools, fills the bill.</p> <p> </p> <p>Robert Moriarty has written a good book based on the common sense learned from decades of experience. He does not intend to make friends or sugarcoat his analysis. He wants to help readers make money investing, but far more importantly, he wants to minimize losses by following basic logic. As he says, "learn to ignore the experts, the gurus, and other fools."<br /> Read the book!<br /> It is easy to read, logical, and rather cynical, based on years of experience watching people do stupid things. The crowd is almost always wrong at turning points. We know this and mostly we forget it. Moriarty reminds us again and again. Look at sentiment, ignore the politicians and experts, especially those with an agenda, and remember that markets always correct and regress to the mean.<br /> Be suspicious of politicians and experts - he gives many examples and is not worried about alienating people. He calls it as he sees it - not everyone will agree.<br /> But the most important chapter, in his opinion and mine, is the chapter "When to Sell." This chapter deserves a second reading.</p> <p> </p> <p>Great little book. Easy to read and very interesting. Good advice and those who take it to heart will be financially rewarded. The problem is it so well written that people who really need to pay attention may not realize how difficult it is to follow his advice. I can't recall the trader who said it but Mr. Moriarty has brilliantly stated the simple part: "It is simple but not easy." This cannot be emphasized enough as NOBODY KNOWS ANYTHING clearly lays it out for those willing to learn. This is one of the best books ever written on investing and don't let the small size or price fool you.</p> <p> </p> <p>Absolutely worth reading. Some of it sounds like crusty old Bob which is ok. Age and wisdom come together when you have a brain. I got one real valuable pearl of advice from his wisdom on how to take a profit from a winning stock. This solved a big problem for me right now. His advice on avoiding listening to shills and fools is spot on. Buy this book.</p> <p> </p> <p>I have many books on investing and the reality is that they have not been worth the purchase price and they certainly haven't helped me make money. Bob Moriarty's book is quite simply one of the best books I have read on investing and I feel will prove to be invaluable to any investor or trader.</p> <p> </p> <p>I've followed Bob Moriarty on his very informative investment web site 321gold for many years and listened to his interviews on financial radio programs. Bob is a true authority on the geo-politics of the world. It then comes as no surprise he's written a concise, educational and in my opinion a must-read book on the psychology of investing, the timing of buying, selling and above all else thinking for yourself. I think it's a great read for the seasoned trader or the newbie investor.</p> <p> </p> <p>A great book that really cuts to the chase about how to speculate properly in the natural resource sector. Bob shares his accumulated wisdom about things that really take years of experience to figure out. The junior resource sector is different than general stock investing and knowing when to get out is arguably more important than knowing when to get in. A true gem in an industry filled with people who make money by telling you what you want to hear or by simply drawing lines that go up in a chart projection.</p> <p> </p> <p> </p><br>

Price History

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messages communication@pricearchive.us