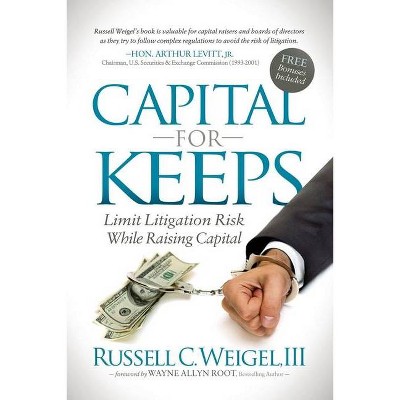

Capital for Keeps - by Russell C Weigel III (Hardcover)

Similar Products

Products of same category from the store

AllProduct info

<p/><br></br><p><b> Book Synopsis </b></p></br></br>Raising Capital for Your Company or Your Real Estate Acquisition? <p>Russell Weigel has been practicing securities law since 1990. For more than ten of these years he was an attorney for the Securities & Exchange Commission. Since 2001, he has been in private practice counseling public and private capital raisers and defending the securities industry and corporate executives from SEC and FINRA enforcement matters. <p>Russell Weigel opens your eyes to the risks of raising capital but shows you a path to minimize these risks. <p>Whether private or public, companies raising capital the wrong way and not properly planning for unforeseen events can result in substantial loss. Capital for Keeps is designed to save the entrepreneur thousands of dollars in legal fees by educating them on their options and the standards of conduct expected of them to stay away from the courthouse.<p/><br></br><p><b> Review Quotes </b></p></br></br><br>"Russell Weigel's book is valuable for capital raisers and boards of directors as they try to follow complex regulations to avoid the risk of litigation." -- Hon. Arthur Levitt, Jr., Chairman, U.S. Securities & Exchange Commission (1993-2001). <p>"Russell's book is a great guide for small company execs. If it doesn't both help you and scare you at the same time, you weren't paying attention." -- Jim Czirr, Executive Chairman, Galectin Therapeutics (NASDAQ: GALT). <p>"Russell takes a very complex subject and presents it in a very readable form. This book is a must-read for startup executives. This information is important, few write about it, and no one else presents it to the people who need it most - the business community." -- Ted Felix, CPA / Former Director AICPA Quality Control Review Division, a former vice-president and trustee of the New Jersey Society of Certified Public Accountants, and for a number of years the co-author of the Thomson Reuters loose-leaf treatise SEC Compliance: Financial Reporting and Forms. <p>Nearly every business from a start up to the most seasoned companies need capital. There are many sources of money. Connecting demand with supply while staying within the rules and regulations governing raising capital is what this book is about. Many people think they are following the correct path when looking to raise capital. Visit any business meeting, real estate investment association meeting or seminar where people are teaching how to connect with money and compare what is said and taught to what is in this book and you will see the problem. When learning a new topic it is wise to listen to an absolute expert. Russell is that person and he generously shares that expertise in this book. --Steve Pohlit, CPA / Real Estate Investing and Business Coach/ StevePohlit.com<br><p/><br></br><p><b> About the Author </b></p></br></br>Russell C. Weigel, III, Esq., a Florida resident, has been practicing securities law since 1990. Mr. Weigel served as an attorney for the Securities and Exchange Commission (1990-2001), and then in private practice worked successively for two law firms as a securities transactional and litigation attorney (2001-2005). Mr. Weigel continued his transactional and litigation securities practice since 2005 at his own law firm. Mr. Weigel is an AV-rated securities attorney, a graduate of Vanderbilt University (B.A., 1986), and the University of Miami School of Law (J.D., 1989). Russell Weigel has been a featured speaker at conferences such as MegaPartnering VI, has taught webinars on securities law topics, and is a regular contributing author to the Microcap Review.

Price History

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messagescommunication@pricearchive.us