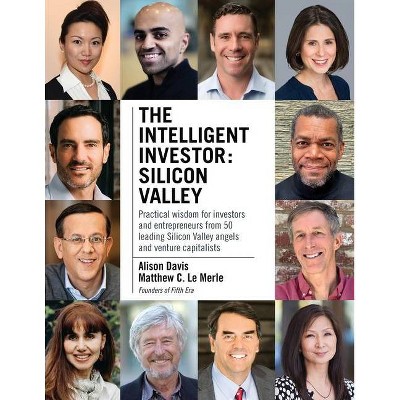

The Intelligent Reit Investor Guide - by Brad Thomas (Hardcover)

Similar Products

Products of same category from the store

AllProduct info

<p/><br></br><p><b> About the Book </b></p></br></br>"The separation of real estate companies and equity REITs from banks and financial institutions should precipitate significant demand not only for publicly traded shares of such companies, but also information about them. Investors and financial advisors will need to learn the lexicon and valuation technics that are specific to REITs, and learn them quickly. The book will feature: Historical industry performance tables Basic information about REITs and the REITs industry Equations, bolstered with examples, needed to calculate key metrics used to identify suitable companies A dictionary that explains the terminology that is specific to the REIT industry A list of publicly-traded REITs: The existing publications do not provide basic listings of publicly-traded REITs. Most stock brokers also do not have a concise, consistent way to identify companies that are REITs."--<p/><br></br><p><b> Book Synopsis </b></p></br></br><p><b>Demystify real estate investment trusts with this masterful guide from an industry expert.</b></p> <p>In <i>The Intelligent REIT Investor Guide</i>, author Brad Thomas walks you through both basic and advanced topics in the profitable, sustainable world of real estate investment trusts. From historical industry performance to the equations needed to calculate key metrics in REIT stocks, this book covers the history, vocabulary, principles, and analysis you'll need to invest wisely in this growing asset class. Find out how you can strengthen your investment decisions and conclusions with publicly traded REITs in the short- and long-terms alike.</p> <p>With this book you'll: </p> <ul> <li>Understand exactly what REITs are, how they work, and why they've achieved such impressive historical returns</li> <li>Discover how REITS have performed over the decades up against other asset classes</li> <li>Compare and contrast the various subsectors - such as residential, retail, office, healthcare, self-storage, lodging, technology, and more - to understand which ones can work better in your personal portfolio.</li> </ul> <p>Perfect for personal and professional investors alike, <i>The Intelligent REIT Investor Guide</i> is an invaluable guide to a crucial asset class that is often overlooked or poorly understood despite its undeniable impact on portfolios over the past 60 years.</p><p/><br></br><p><b> From the Back Cover </b></p></br></br><p><b>PRAISE FOR THE INTELLIGENT REIT INVESTOR GUIDE</b> </p><p>"The simple genius of public REITs is that they turn bricks and mortar into transparent and predictable liquid assets. Since they tend to pay high dividends, REITs can serve as a terrific addition to an investment portfolio. Thomas' book helps break down this asset class for the average person, making REITs more understandable, and therefore more accessible, to everyone."<br><b>--SAM ZELL, </b> Founder and Chairman, Equity Group Investments</p><p>"Brad has been a longtime follower of REITs and a contributor to the growth of the REIT industry. He has a broad knowledge of the industry, deep connections, and an intellectual curiosity that help shine a light on this often misunderstood investment vehicle. One of Brad's mentors, Ralph Block, to whom the book is dedicated, was not only one of the greatest gentlemen I've had the pleasure of knowing, but also a disciple and true visionary of the REIT industry."<br><b>--CRAIG LEUPOLD, </b> CEO, GSI Capital Advisors </p><p>"In just 30 years, the REIT market has grown to a diverse $2 trillion global opportunity. Yet there remain a great number of misconceptions about the nature and behavior of equity REITs. Brad Thomas' book provides readers a wealth of tools and insights to appreciate--and potentially profit from--this asset class." <br><b>--JOSEPH M. HARVEY, </b> President, Cohen & Steers </p><p/><br></br><p><b> About the Author </b></p></br></br><p><b>BRAD THOMAS</b> is the CEO and Senior Analyst at Wide Moat Research, a boutique financial newsletter company that covers a wide range of investment strategies focused on dividend growth stocks. In addition, Thomas is the guru behind several newsletter products including <i>Forbes Real Estate Investor, The Intelligent REIT Investor</i>, and the <i>Intelligent REIT Options Advisor</i>. He is a frequent contributor on Fox & Friends, Fox Business, and TD Ameritrade in addition to contributing regularly to Seeking Alpha, Forbes.com, and <i>The Property Chronicle</i>. In addition to his real estate interests, Thomas is an accomplished and sought-after speaker throughout the U.S. and on the international stage. He graduated from Presbyterian College in Clinton, SC, and guest lectures frequently at many leading universities.</p><p><b>RALPH BLOCK</b> was a leading authority on REITs and an active participant in the industry for seven decades who died on September 6, 2016. Author of the book <i>Investing in REITs</i>, he also founded <i>The Essential REIT</i>, a newsletter dedicated to REITs and REIT investing. In addition, Block was a regular contributor to <i>REIT</i> magazine and wrote weekly blog posts for SNL Financial. Block began investing in REIT stocks in the 1970s, and he held a variety of professional investment and advisory positions in the industry from 1993 onwards. Block practiced corporate and securities law in Los Angeles for 27 years before focusing on REITs. He graduated from UCLA and the UCLA School of Law, where he was on the board of editors of the <i>UCLA Law Review</i>.</p>

Price History

Cheapest price in the interval: 24.49 on November 8, 2021

Most expensive price in the interval: 24.49 on December 20, 2021

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messagescommunication@pricearchive.us