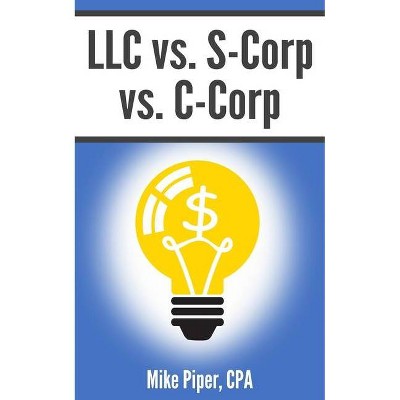

LLC vs. S-Corp vs. C-Corp - by Mike Piper (Paperback)

Similar Products

Products of same category from the store

AllProduct info

<p/><br></br><p><b> Book Synopsis </b></p></br></br><p><strong>The "LLC, S-Corp, or C-Corp" question is one of essential importance: </strong></p><p><strong>Make the right decision, </strong> and you'll be paying less tax; you'll know your personal assets are protected from lawsuits against your business; and you might even save yourself some money on accounting and legal fees.</p><p><strong>Make the wrong decision, </strong> and you'll be paying an unnecessary amount of tax; you'll be wasting money on legal bills; and you'll be only a lawsuit away from losing your home and other personal assets.</p><p><strong>Find the following, explained in plain-English with no legal jargon: </strong></p><ul><li>The basics of sole proprietorship, partnership, LLC, S-Corp, and C-Corp taxation.</li><li>How to protect your personal assets from lawsuits against your business.</li><li>When the protection offered by an LLC will work. (And more importantly, when it will not!)</li><li>Which business structures could reduce your federal income tax or self-employment tax.</li></ul>

Price History

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messages communication@pricearchive.us

![Godzilla vs. Destoroyah/Godzilla vs. Megaguirus [Blu-ray]](https://pisces.bbystatic.com/image2/BestBuy_US/images/products/5955/5955035_so.jpg)