Similar Products

Products of same category from the store

AllProduct info

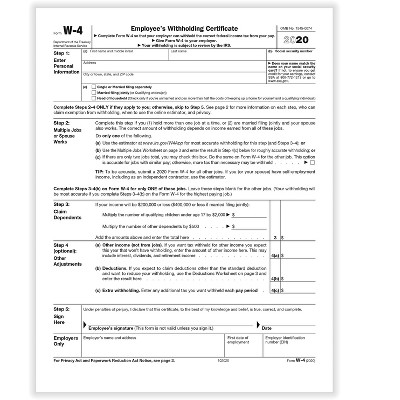

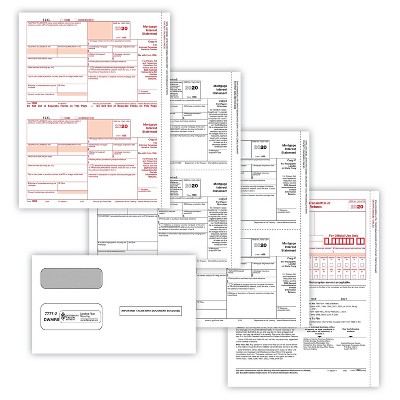

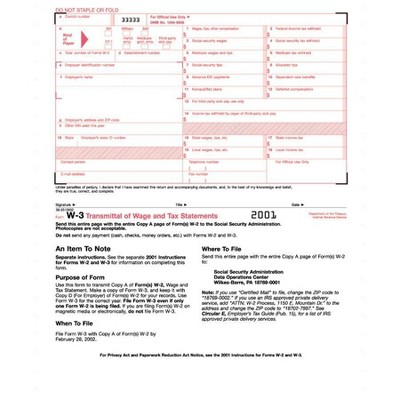

The Internal Revenue Service (IRS) requires every employee to complete W-4 form before they may claim withholding allowances on income tax returns. New W-4 Dorm must also be completed whenever an employee's tax status changes, such as with the birth of a child or a change in marital status. The updated W-4 form is called the Employee's Withholding Certificate. “Allowance” has been removed from the name because there are no longer any withholding allowances, formerly Box 5. Both the form and instructions for completion are up to a full page. Additionally, under Step 4 (B), which is the Deductions Worksheet, the percentage of medical expenses that may be included when estimating 2020 deductions changed from in excess of 10% of income to 7.5% of income. The new form better incorporates changes led by the Tax Cuts and Jobs Act, which permits employees to more precisely estimate the amount of tax they ask their employers to withhold from their paychecks. Employees who have submitted W-4 form in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee's most recently submitted W-4 form. New W-4 form must be completed whenever an employee's tax status changes, such as with the birth of a child or a change in marital status. Single-part W-4 tax form. For laser printers. Contains 50 forms per pack. Maintaining a current W-4 form on each employee is required by the IRS; keep a supply for new hires and employee changes. New form better incorporates changes led by the Tax Cuts and Jobs Act, which permits employees to more precisely estimate the amount of tax they ask their employers to withhold from their paychecks. Sold as 1 Each.

Price History

Price Archive shows prices from various stores, lets you see history and find the cheapest. There is no actual sale on the website. For all support, inquiry and suggestion messagescommunication@pricearchive.us